- You can’t drive alone with a permit in any state

- Most states require you to obtain a permit before acquiring a driver’s license

- A learner’s permit allows drivers to practice driving with an adult in the vehicle to teach them

A learner’s permit is the first step in obtaining a driver’s license and driving on your own. However, that doesn’t mean you can drive alone with only a permit.

In fact, no state allows you to drive alone with merely a permit, except in rare, life-threatening circumstances. Although a permit enables you to learn to operate a motor vehicle, you must have an adult with you at all times.

Your state determines the penalty for driving alone with a permit, but typically you will have to wait even longer to acquire your driver’s license. In addition, your auto insurance rates will increase if you cause an accident while driving by yourself.

Continue reading to learn more about driving alone with a permit and the potential penalties you may face.

Can you drive alone with a permit?

Most drivers with a learner’s permit are teens or young drivers. States require all new drivers to be accompanied by an adult, usually a parent or guardian.

Driving a vehicle is dangerous and requires a certain amount of skill and attention. Therefore, inexperienced drivers need an experienced adult to teach them safe driving skills.

According to the Centers for Disease Control and Prevention, 2,400 teens were killed in car accidents in 2019. In addition, having other young passengers increases the chances of an accident.

There are strict guidelines put in place for permitted drivers. However, every state has its own rules. And they all agree that you can’t drive by yourself with a permit.

This table discloses the rules for permitted drivers by state. While some states allow drivers as young as 14 to acquire a learner’s permit, most states require new drivers to be at least 15 years old.

| State | Minimum Age For A Permit | Drive Alone With A Permit | Who Accompanies Permitted Driver | Other Passengers Allowed |

|---|---|---|---|---|

| Alabama | 15 | No | A parent, legal guardian, or licensed adult over the age of 21 must be seated in the front passenger seat. | No more than one non-family passenger. |

| Alaska | 14 | No | A licensed driver who is at least 21 years of age and has a minimum of one year’s driving experience in the type of vehicle you are driving must be seated in the front passenger seat. | No non-family passengers under 21. |

| Arizona | 15 ½ | No | A licensed driver over the age of 21 must always be seated in the front passenger seat. | No more than 1 non-family member under 18. |

| Arkansas | 14 | No | A licensed driver over the age of 21must always be seated in the front passenger seat. | No more than one non-family member under the age of 21. |

| California | 15 1/2 | No | A parent, guardian, spouse, or adult over the age of 25 with a California license must be present in the front passenger seat. | No non-family members under the age of 20. |

| Colorado | 15 (With Driver Ed) 16 (Without Driver Ed) | No | A parent, guardian, driving instructor, or licensed adult over the age of 21 must be present in the front passenger seat. | No non-family passengers. |

| Connecticut | 16 | No | A parent, legal guardian, or certified instructor must be present in the front passenger seat. | No passengers are other than the driving instructor, parent, or legal guardian. |

| Delaware | 16 | No | A parent, guardian, or licensed driver who is at least 25 and has held a license for at least five years must be present in the front passenger seat. | No more than one non-family passenger. |

| Florida | 15 | No | A parent, guardian, or adult who is at least 21 years old must be present in the front passenger seat. | No non-family passengers. |

| Georgia | 15 | No | A parent, legal guardian, or adult who is at least 21 years old and has a valid license must be present in the front passenger seat. | No non-family passengers. |

| Hawaii | 15 1/2 | No | A parent, legal guardian, or adult who is at least 21 years old and has a valid license must be present in the front passenger seat. | No more than one non-family passenger under the age of 18. |

| Idaho | 14 1/2 | No | Must be accompanied by a driver who is at least 21 years old and seated in the front passenger seat. | No non-family passengers. |

| Illinois | 15 | No | Must be accompanied by someone who is at least 21 years old, has a valid license, and has at least one year of driving experience. | No more than one non-family passenger under the age of 20. |

| Indiana | 15 (With Drivers Ed) 16 (Without Drivers Ed) | No | Must be accompanied by an adult who is at least 25 years of age or a spouse who is at least 21 years of age. | No non-family passengers. |

| Iowa | 14 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family passenger under the age of 18 unless waived by parents. |

| Kansas | 14 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-sibling passenger. |

| Kentucky | 16 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family passenger unless supervised by an instructor. |

| Louisiana | 15 | No | Must be accompanied by a parent, guardian, or licensed driver over 21 years old. | No more than one non-family member under the age of 21 between 6 PM and 5 AM. |

| Maine | 15 | No | Must be accompanied by an adult who is at least 20 and has held a valid license for at least two years. | No non-family passengers. |

| Maryland | 15 ¾ | No | Must be accompanied by a qualified driver who is at least 21 and has held a valid license for at least three years. | No non-family passengers under 18 years old. |

| Massachusetts | 16 | No | Must be accompanied by a parent or guardian who has held a valid license for at least one year. | No non-family passengers under 18 years old. |

| Michigan | 14 ¾ | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family passenger under 21 years old. |

| Minnesota | 15 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family member under 20 years old. |

| Mississippi | 15 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No non-family passengers. |

| Missouri | 15 | No | Must be accompanied by a parent, legal guardian, grandparent, instructor, or licensed driver over the age of 25 who has had their license at least three years. | No more than one non-family member under 19 years old. |

| Montana | 14 ½ | No | Must be accompanied by a parent, guardian, or licensed driver over the age of 18. | No more than one non-family member under 18 years old. |

| Nebraska | 15 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family member under 19 years old. |

| Nevada | 15 ½ | No | Must be accompanied by a licensed driver who is at least 21 years old. | No non-family passengers under 18 years old. |

| New Hampshire | 15 ½ | No | Do not issue “learner permits” but instead people get their license and have a probationary period. | No more than one non-family member under 25. |

| New Jersey | 16 | No | Must be accompanied by an adult over the age of 21 who has held a valid license for at least 3 years. | No more than one passenger. |

| New Mexico | 15 | No | Must be accompanied by another licensed driver. | No more than one non-family member under 21 years old. |

| New York | 16 | No | Must be accompanied by a licensed adult over 21 years of age. | No more than one non-family member under 21 years old. |

| North Carolina | 15 | No | Must be accompanied by an adult with a valid driver’s license. | No more than one non-family member under 21 years old. If carrying a family member under 21, no other passengers. |

| North Dakota | 14 | No | Must be accompanied by a licensed adult who has at least three years of driving experience and is 18 years or older. | No restrictions. |

| Ohio | 15 ½ | No | Must be accompanied by an adult over the age of 21 who holds a valid license. | No more than one passenger. |

| Oklahoma | 15 ½ | No | Must be accompanied by an adult over 21 years of age who has held a valid license for at least two years. | No more than one passenger. |

| Oregon | 15 | No | Must be accompanied by a licensed adult who is at least 21 years old. | No non-family passengers under the age of 20. |

| Pennsylvania | 16 | No | Must be accompanied by a licensed driver who is at least 21 years of age or a parent, guardian, or spouse who is at least 18 years old and licensed. | No more than one non-family member under 18 years old. |

| Rhode Island | 16 | No | Must be accompanied by an adult at least 20 years of age who has held a valid license for at least 5 years. | No more than one non-family member under 21 years old. |

| South Carolina | 15 | No | Must be accompanied by a licensed driver who is at least 21 years of age. | No more than 2 passengers under the age of 21 years old. |

| South Dakota | 14 | No | Must be accompanied by a parent or legal guardian who is licensed. | No non-family passengers. |

| Tennessee | 15 | No | Must be accompanied by a licensed driver who is at least 21 years old. | No more than one non-family member. |

| Texas | 15 | No | Must be accompanied by a licensed driver who is at least 21 years old and has held a valid license for at least one year. | No more than one non-family member under 21 years old. |

| Utah | 15 | No | Must be accompanied by a licensed adult who is at least 21 years old. | No non-family passengers. |

| Vermont | 15 | No | Must be accompanied by an unimpaired parent, legal guardian, or certified instructor. | No non-family passengers. |

| Virginia | 15 ½ | No | Must be accompanied by a licensed adult who is at least 21 years of age or a licensed spouse over the age of 18. | No more than one non-family passenger under 21 years old. |

| Washington | 15 (With Drivers Ed) 15 ½ (Without Drivers Ed) | No | Must be accompanied by someone who has held a valid license for at least five years. | No non-family passengers under 20 years old. |

| West Virginia | 15 | No | Must be accompanied by a licensed adult who is at least 21 years of age. | No non-family passengers under 20 years old. |

| Wisconsin | 15 ½ | No | Must be accompanied by a licensed adult who is at least 25 years of age and has held a valid license for at least 2 years. | No more than one passenger. |

| Wyoming | 15 | No | Must be accompanied by a licensed driver who is at least 18 years of age. | No more than one non-family member under 18 years old. |

Can you drive by yourself with a permit in an emergency?

Some states allow permitted drivers behind the wheel alone in a medical emergency. For example, although California law states that a licensed driver over age 25 must be in the front passenger’s seat, you could drive to the hospital in an emergency.

What are the penalties for driving alone with a permit?

If you drive alone with only a permit and get stopped by the police, chances are you will end up with a fine. In addition, you’ll probably have to wait longer to obtain your driver’s license. In fact, your wait time for a driver’s license may double, depending on your state.

However, if you get into an accident while driving alone with a permit, the consequences are more severe. Although you will still receive the fine and experience a longer wait time for your license, you may have to pay out of pocket for damages resulting from the accident.

You don’t have to add your permitted driver to your auto insurance policy in most states. Instead, your policy will automatically cover your new driver as long as they follow the rules.

If your permitted driver breaks the rules by driving alone, your insurance may or may not cover damages. Also, if you didn’t inform your auto insurance company about the new driver, it may deny your claim.

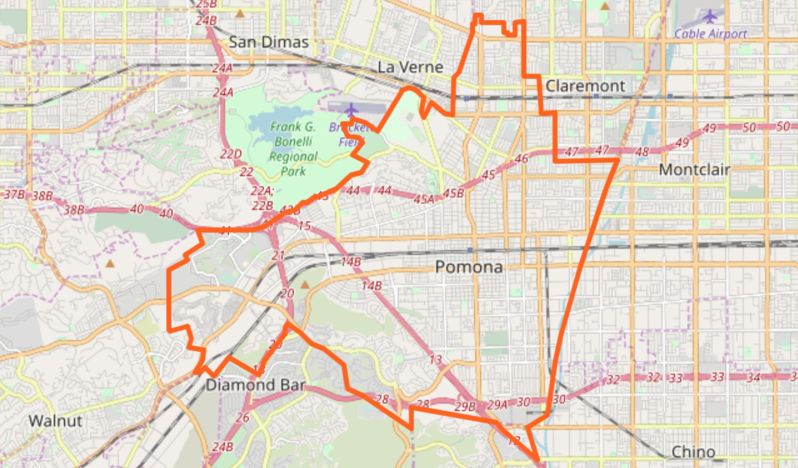

For example, if your teen drives alone with only a permit in California, your Los Angeles car insurance may not cover damages from an accident. Paying for property damages and bodily injuries out of pocket may be next to impossible.

In addition, you may have to pay for damages yourself if you don’t have the correct coverages. Even if your car insurance covers damages caused by your permitted driver, you still need to have the proper coverages in place.

Although most states require drivers to have liability car insurance, it only covers damages and injuries to others. Your vehicle isn’t covered at all.

Add collision and comprehensive coverages to pay for damages to your vehicle from an accident, fire, theft, vandalism, and other events.

How much does insurance increase after an accident? Your auto insurance will increase by approximately $80 a month after one accident. That’s in addition to already high rates for new drivers.

How is a learner’s permit different than a driver’s license?

Every state has graduated licensing, which means that there are several steps to the process of procuring a driver’s license.

First, a learner’s permit allows new drivers to practice driving with a licensed adult to learn how to drive correctly. Obtaining a permit is different in each state but usually involves a written knowledge test to ensure that the new driver understands the rules of the road.

Next, a restricted license is issued after passing a driving test, depending on the driver’s age. Young drivers have restrictions regarding when they can drive and how many passengers are allowed. Again, the limits are in place for a set amount of time.

Some states allow drivers over 18 to omit this step and pursue a regular license.

Finally, a driver’s license is issued once all restrictions have expired. At this point, drivers simply have to renew their license at the appropriate time and have no other restrictions.

Whether or not you must have a permit before a license depends on your state and age. While drivers need to pass the permit tests, some states may allow a driver to obtain a permit and take the licensing test on the same day. In other states, drivers have to keep their permits for a specific amount of time.

Driving Alone With A Permit: The Bottom Line

You can’t drive alone with a permit, and you must have a licensed adult in the front passenger’s seat. However, some states allow you to drive alone in emergencies.

If you are caught driving alone with a permit, you can be fined, and you will have to wait longer to acquire your driver’s license.

Additionally, your auto insurance may not cover an accident if you drive alone with a permit. It will be up to your insurance company to decide if you have to pay for damages yourself.

Although a permit is the first step in obtaining a driver’s license, your state and age determine how long the process takes to complete. Therefore, driving with only a permit will drastically increase your wait time, not to mention your car insurance rates.

References: